we provide Refined AHIP AHM-520 practice which are the best for clearing AHM-520 test, and to get certified by AHIP Health Plan Finance and Risk Management. The AHM-520 Questions & Answers covers all the knowledge points of the real AHM-520 exam. Crack your AHIP AHM-520 Exam with latest dumps, guaranteed!

Check AHM-520 free dumps before getting the full version:

NEW QUESTION 1

With regard to the financial statements prepared by health plans, it can correctly be stated that

- A. both for-profit, publicly owned health plans and not-for-profit health plans are required by law to provide all interested parties with an annual report

- B. a health plan's annual report typically includes an independent auditor's report and notes to the financial statements

- C. any health plan that owns more than 20% of the stock of a subsidiary company must compile the financial statements for the health plan's annual report on a consolidated basis

- D. a health plan typically must prepare the financial statements included in its annual report according to SAP

Answer: B

NEW QUESTION 2

One true statement about a health plan's underwriting margin is that

- A. the only way that the health plan can effectively reduce its exposure to underwriting risk, and therefore adjust its underwriting margin, is to control anti selection

- B. a larger assumed underwriting margin will reduce the price of the health plan's product and will make the plan more competitive

- C. the health plan's purchase of stop-loss insurance has no effect on its underwriting margin because stop-loss insurance can help the health plan control its expenses but not its underwriting risk

- D. both the level of underwriting risk that the health plan assumes in providing benefits and the market competition it encounters most likely directly affect the size of its assumed underwriting margin

Answer: D

NEW QUESTION 3

The following statements are about various reimbursement arrangements that health plans have with hospitals. Select the answer choice containing the correct statement.

- A. A sliding scale per-diem charges arrangement differs from a sliding scale discount on charges arrangement in that only a sliding scale per-diem charges arrangement is based on total volume of admissions and outpatient procedures.

- B. Under a typical reimbursement arrangement that is based on diagnosisrelated groups (DRGs), if the payment amount is fixed on the basis of diagnosis, then any reduction in costs resulting from a reduction in days will go to the health plan rather than to the hospital.

- C. A negotiated straight per-diem charge requires payment of a single charge for a day in the hospital, regardless of any actual charges or costs incurred during the hospital stay.

- D. A straight discount on charges arrangement is the most common reimbursement method in markets with high levels of health plans.

Answer: C

NEW QUESTION 4

The following statements are about the capital budgeting technique known as the payback method. Select the answer choice containing the correct statement:

- A. The main benefit of the payback method is that it is simple to use.

- B. The payback method measures the profitability of a given capital project.

- C. The payback method considers the time value of money.

- D. The payback method states a proposed project’s cash flow in terms of present value for the life of the entire project.

Answer: A

NEW QUESTION 5

In order to print all of its forms in-house, the Prism health plan isconsidering the purchase

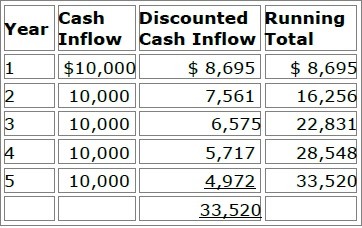

of 10 new printers at a total cost of $30,000. Prismestimates that the proposed printers have a useful life of 5 years. Under itscurrent system, Prism spends $10,000 a year to have forms printed by a localprinting company. Assume that Prism selects a 15% discount rate based onits weighted-average costs of capital. The cash inflows for each year,discounted to their present value, are shown in the following chart:

Prism will use both the payback method and the discounted payback methodto analyze the worthiness of this potential capital investment. Prism's decisionrule is to accept all proposed capital projects that have payback periods offour years or less.

Now assume that Prism decides to use the net present value (NPV) method toevaluate this potential investment's worthiness and that Prism will accept theproject if the project's NPV is greater than $4,000. Using the NPV method,Prism would correctly conclude that this project should be

- A. Rejected because its NPV is $3,520

- B. Accepted because its NPV is $5,028

- C. Accepted because its NPV is $16,480

- D. Accepted because its NPV is $23,520

Answer: A

NEW QUESTION 6

The amount of risk for health plan products is dependent on the degree of influence and the relationships that the health plan maintains with its providers. Consider the following types of managed care structures:

✑ Preferred provider organization (PPO)

✑ Group model HMO

✑ Staff model health maintenance organization (HMO)

✑ Traditional health insurance

Of these health plan products, the one that would most likely expose a health plan to the highest risk is the:

- A. preferred provider organization (PPO)

- B. group model HMO

- C. staff model health maintenance organization (HMO)

- D. traditional health insurance

Answer: C

NEW QUESTION 7

When pricing its product, the Panda Health Plan assumes a 4% interest rate on its investments. Panda also assumes a crediting interest rate of 4%.

The actual interest rate earned by Panda on the assets supporting its product is 6%. The following statements can correctly be made about the investment margin and interest margin for Panda's products.

- A. Panda most likely built the crediting interest rate of 4% into the investment margin of its product.

- B. Panda's investment margin is the difference between its actual benefit costs and the benefit costs that it assumes in its pricing.

- C. The interest margin for this product is 2%.

- D. All of these statements are correct.

Answer: C

NEW QUESTION 8

The Caribou health plan is a for-profit organization. The financial statements that Caribou prepares include balance sheets, income statements, and cash flow statements. To prepare its cash flow statement, Caribou begins with the net income figure as reported on its income statement and then reconciles this amount to operating cash flows through a series of adjustments. Changes in Caribou's cash flow occur as a result of the health plan's operating activities, investing activities, and financing activities.

To prepare its cash flow statement, Caribou uses the direct method rather than the indirect method.

- A. True

- B. False

Answer: B

NEW QUESTION 9

The following transactions occurred at the Lane Health Plan:

✑ Transaction 1 — Lane recorded a $25,000 premium prior to receiving the payment

✑ Transaction 2 — Lane purchased $500 in office expenses on account, but did not record the expense until it received the bill a month later

✑ Transaction 3 — Fire destroyed one of Lane’s facilities; Lane waited until the facility was rebuilt before assessing and recording the amount of loss

✑ Transaction 4 — Lane sold an investment on which it realized a $14,000 gain; Lane recorded the gain only after the sale was completed.

Of these transactions, the one that is consistent with the accounting principle of conservatism is:

- A. Transaction 1

- B. Transaction 2

- C. Transaction 3

- D. Transaction 4

Answer: D

NEW QUESTION 10

Dr. Jacob Winburne is compensated by the Honor Health Plan under an arrangement in which Honor establishes at the beginning of a financial period a fund from which claims approved for payment are paid. At the end of the given period, any funds remaining are paid out to providers. This information indicates that the arrangement between Dr. Winburne and Honor includes a provider incentive known as a:

- A. Risk pool, and any deficit in the fund at the end of the period would be the sole responsibility of Honor

- B. Risk pool, and any deficit in the fund at the end of the period would be paid by both D

- C. Winburne and Honor according to percentages agreed upon at the beginning of the contract period

- D. Withhold, and any deficit in the fund at the end of the period would be the sole responsibility of Honor

- E. Withhold, and any deficit in the fund at the end of the period would be paid by both D

- F. Winburne and Honor according to percentages agreed upon at the beginning of the contract period

Answer: A

NEW QUESTION 11

The Sesame health plan uses a method of accumulating cost data that enables the health plan to satisfy financial reporting requirements for compiling financial statements and corporate tax returns. Although this method assists Sesame's managers in studying which types of costs are rising and falling over time, it does not explain which areas of Sesame incur each cost. This method, which is the most basic level of cost accumulation, is known as accumulating costs by

- A. Cost center

- B. Type of cost

- C. Lines of business

- D. Function

Answer: B

NEW QUESTION 12

Analysts will use the capital asset pricing model (CAPM) to determine the cost of equity for the Maxim health plan, a for-profit plan. According to the CAPM, Maxim's cost of equity is equal to

- A. The average interest rate that Maxim is paying to debt holders, adjusted for a tax shield

- B. Maxim's risk-free rate minus its beta

- C. Maxim's risk-free rate plus an adjustment that considers the market rate, at a given level of systematic (non diversifiable) risk

- D. Maxim's risk-free rate plus an adjustment that considers the market rate, at a given level of nonsystematic (diversifiable) risk

Answer: C

NEW QUESTION 13

The Cardinal health plan complies with all of the provisions of HIPAA.

Cardinal has received requests for healthcare coverage from the following companies that meet the statutory definition of a small group:

✑ The Xavier Company has excellent claims experience

✑ The Youngblood Company has not previously offered group healthcare coverage to its employees

✑ The Zebulon Company has poor claims experience

According to HIPAA's provisions, Cardinal must issue a healthcare contract to

- A. Xavier, Youngblood, and Zebulon

- B. Xavier and Youngblood only

- C. Xavier only

- D. None of these companies

Answer: A

NEW QUESTION 14

The Nuevo health plan's capital structure consists of 30% debt and 70% equity. Nuevo's average after-tax cost of debt is 6% and its cost of equity is 12%. The following statement(s) can correctly be made about Nuevo's weighted average cost of capital (WACC):

- A. Nuevo has a WACC of 10.2%

- B. If Nuevo establishes its WACC as the handle rate for capital investments, then it can expect an investment to add value to the health plan only if the investment is expected to earn a return of less than Nuevo's WACC

- C. Both A and B

- D. A only

- E. B only

- F. Neither A nor B

Answer: B

NEW QUESTION 15

An actuary for the Noble Health Plan observed that the plan's actual morbidity was lower than its assumed morbidity and that the plan's actual administrative expenses were higher than its assumed administrative expenses. In this situation, Noble's actual underwriting margin was

- A. larger than its assumed underwriting margin, and the plan's actual expense margin was higher than its assumed expense margin

- B. larger than its assumed underwriting margin, but the plan's actual expense margin was lower than its assumed expense margin

- C. smaller than its assumed underwriting margin, but the plan's actual expense margin was higher than its assumed expense margin

- D. smaller than its assumed underwriting margin, and the plan's actual expense margin was lower than its assumed expense margin

Answer: B

NEW QUESTION 16

A product is often described as having a thin margin or a wide margin. With regard to the factors that help determine the size of the margin of a health plan's product, it can correctly be stated that the

- A. greater the risk a health plan assumes in a health plan, the thinner the product margin should be

- B. more that competition acts to force prices down, the wider the product margins tend to become

- C. greater the demand for the product, the thinner the margin for this product tends to become

- D. longer the premium rates are guaranteed to a group, the wider the health plan's margin should be

Answer: D

NEW QUESTION 17

The following statements are about a health plan's pricing of a preferred provider organization (PPO) plan. Three of the statements are true, and one statement is false. Select the answer choice containing the FALSE statement.

- A. Typically, the first step in pricing a PPO is to develop a base indemnity claims cost, which results from adjusting the indemnity plan as though the entire eligible group of employees is enrolled in the indemnity plan.

- B. To develop the expected claims costs for the in-network PPO plan, the health plan's actuaries adjust the base indemnity claims costs to reflect pertinent characteristics of the plan, including the specific network plan design and provider discount arrangements.

- C. One difficulty in pricing a PPO is that the health plan's actuaries have no method of estimating which employees would be likely to select which provider groups.

- D. After the health plan's actuaries use risk adjustment factors to adjust the existing claims costs for selection issues, the actuaries weight the in network and out-of-network costs to arrive at a composite claims cost for the PPO plan.

Answer: C

NEW QUESTION 18

Users of the Fulcrum Health Plan financial information include:

✑ The independent auditors who review Fulcrum's financial statements

✑ Fulcrum's controller (comptroller)

✑ Fulcrum's plan members

✑ The providers that deliver healthcare services to Fulcrum plan members

✑ Fulcrum's competitors

Of these users, the ones that most likely can correctly be classified as external users with a direct financial interest in Fulcrum are the

- A. Independent auditors, the plan members, the providers, and the

- B. Competitors only

- C. Independent auditors, the controller, and the providers only

- D. Controller and the competitors only

- E. Plan members and the providers only

Answer: D

NEW QUESTION 19

Kevin Olin applied for individual healthcare coverage from the Mercury health plan. Before issuing the policy, Mercury's underwriters attached a rider that excludes from coverage any loss that results from Mr. Olin's chronic knee problem. This information indicates that Mr. Olin's policy includes

- A. a moral hazard rider

- B. an essential plan rider

- C. an impairment rider

- D. an insurable interest rider

Answer: C

NEW QUESTION 20

......

Recommend!! Get the Full AHM-520 dumps in VCE and PDF From Dumps-files.com, Welcome to Download: https://www.dumps-files.com/files/AHM-520/ (New 215 Q&As Version)